Reimagining Financial Literacy Through Education and Purpose

Schedule a consultation today!

Generational Wealth Begins With Generational Knowledge™

Introduction

Many factors shape our financial journey, including our early experiences and exposure to financial education. These experiences create a blueprint for financial solvency, influencing our decision-making and relationship with money. In this blog, we will explore the profound impact of our internal and external ecosystems on our financial mindset and discuss the importance of reimagining financial literacy through education and purpose.

The Power of Early Experiences

Our first memories of conversations about money can have a lasting impact on our understanding of its effects on confidence and opportunity. Catchphrases like "I am so broke, I can't pay attention" or "Robbing Peter to Paul" and the proverbial "Money Don't Grow on Trees" can shape our perception of money. As we grow older, we realize that money provides more than just material possessions; it offers education opportunities, safety, and the ability to create a financial footprint creating generational wealth. It offers education opportunities, safety, and the ability to create a financial footprint, which can eventually lead to generational wealth.

The Influence of Internal and External Ecosystems

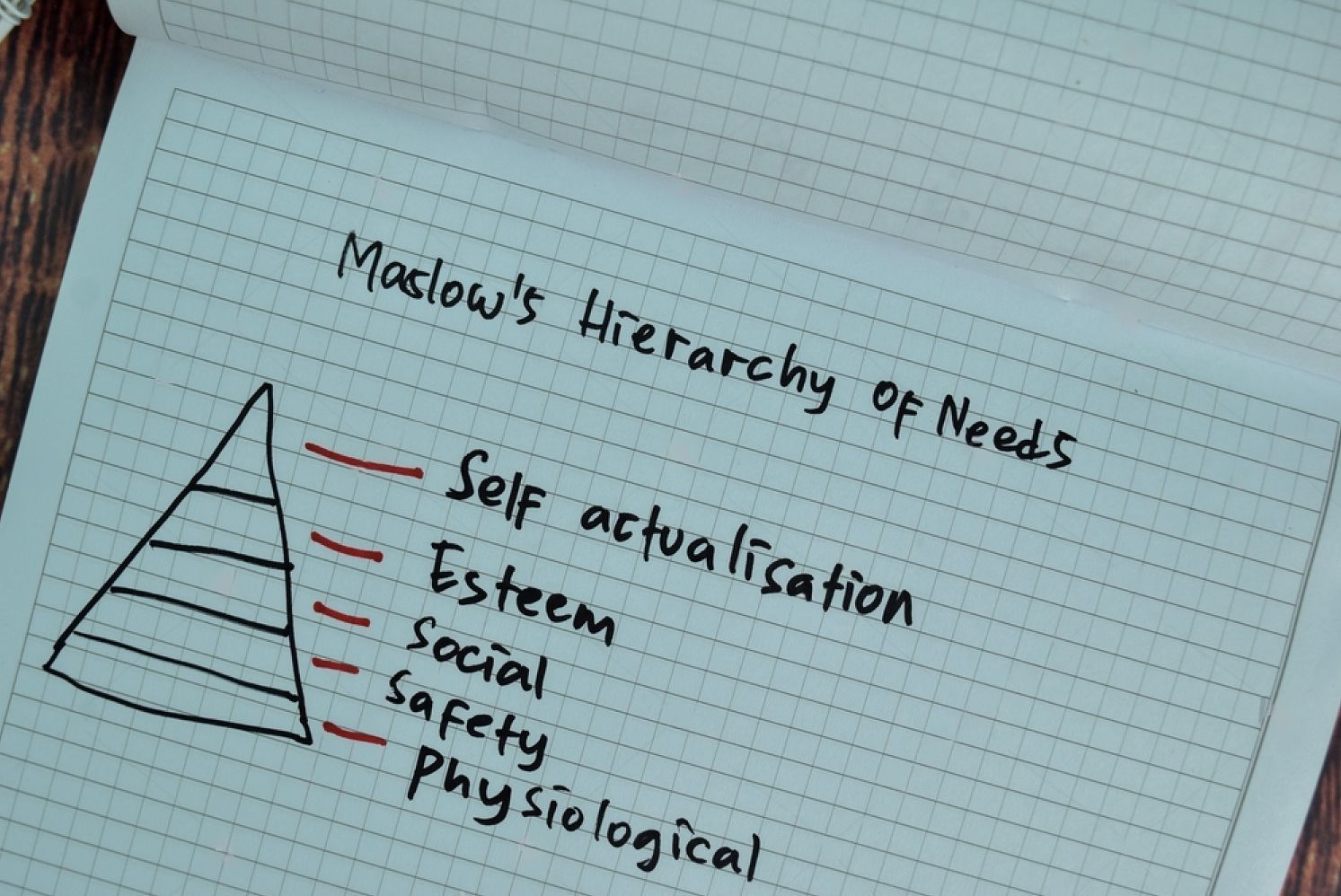

Both our internal and external ecosystems significantly shape our financial relationships. Our internal ecosystem consists of our culture and learned behavior, which are crucial to our financial mindset. Likewise, our external ecosystem, including our neighborhood, lifestyle, and community, can provide or limit opportunities.

Being surrounded by limited resources and a lack of safety can create a sense of learned helplessness and restrict our opportunities for financial growth. On the other hand, if materialistic success is heavily emphasized, our perception of financial well-being may become skewed. Recognizing the impact of these factors is vital in understanding our financial journey and the barriers we may face.

Check out my book, available now in Amazon! WELFARE TO WORK

Reprogramming the Financial Mindset

Our internal and external factors can become hidden barriers ingrained in our hippocampus, the part of the brain responsible for long-term memory formation and retrieval. They form our "money script." Reprogramming this mindset requires healing and communication to identify these ingrained circumstances and reshape our financial genetic code. It is a crucial step in the Generational Wealth Model, acknowledging that each person's experience and relationship with money is unique. Overcoming generational barriers, lack of education, mistrust, and learned helplessness is challenging, but it is the starting point for change.

Dr. Wallace Seven Stage Generational Wealth Model

To break free from negative financial patterns, we must recognize the influence of our internal and external ecosystems. The seven-stage Generational Wealth Model was created to prioritize this recognition. By understanding these influences and challenging old beliefs, we can redefine our financial journey and strive for lasting financial well-being, emphasizing how Generational Wealth begins with Generational Knowledge.

Emphasizing Education and Purpose

In conclusion, our financial journey is profoundly influenced by our early experiences and exposure to financial education. We must shift from a linear approach to an organic philosophy and development to reimagine financial literacy. Understanding and addressing the impact of our internal and external ecosystems and the language and images encountered during childhood is crucial.

By reimagining financial literacy through education and purpose, we empower ourselves to overcome barriers, reshape our financial mindset, and build a legacy of financial well-being for ourselves and future generations. Let us embrace this transformative journey and strive for a brighter financial future.

Leave a comment and follow me on my social media platforms for more blogs and content.